€60M

reserved for top early-stage and growth startups

€0.25-5M

investment range

We support you from day one

We support founders at every stage – helping you stand out, scale fast, and succeed.

We’ve been in your shoes

We’ve spent 25+ years building tech companies and 10+ years working with AI and machine learning.

€110M

raised by our portfolio companies in follow-on rounds

4.8/5 our rating on Landscape.vc

We’re here to help you grow

Our portfolio companies have attracted 9x in follow-on funding, totalling €110M.

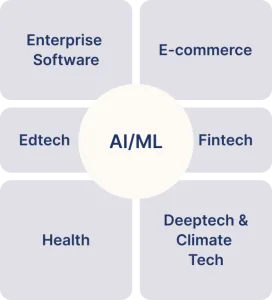

How we invest

Pre-Seed

Seed

Series A

Growth

How we support founders

We don’t just invest – we roll up our sleeves and help you build.

Movens team – ex-operators who have built and scaled tech companies

Direct access to 300+ international VCs, when you are ready to raise

Hands-on pricing strategy support from our in-house pricing expert (Maciej Kraus)

Direct access to 100+ operational experts

We’re here to help you grow

Maciej Kraus

We’re here to help you grow

Artur Banach

A seasoned entrepreneur and investor, currently Partner at Movens Capital, investing €0.25m–€3m in ambitious CEE tech startups.

-

Former CEO & founder of NetSprint (2000-2018), evolved from Poland’s leading search engine into a major European adtech/martech group.

- Partner at Movens Fund 1 (2020–2023), investing €14 million in 20 tech startups, generating over €110 million in follow-on funding.

- Earlier, invested in 9 tech companies, with 6 successful exits (avg. 9x CoC).

- Graduate of VC Executive Program at UC Berkeley; speaker and member of the IAB Europe Trading Committee.

- Portfolio highlights: Vue Storefront, Packhelp, Doctor.one, Demoboost, SKY ENGINE AI, Talkie.ai.

- Sectors expertise: AI, eCommerce, Fintech, SaaS, and Marketplaces.

Happy to anwswer your questions:

Łukasz Pawłowski

20+ years of experience as M&A advisor, investment banker and investor.

- 15 years of corporate finance and M&A advisory experience – at Ernst & Young Corporate Finance, CAG (now MacDonald & Associates) and Espirito Santo Investment Bank (now Haitong Bank).

- Proven track record of 25+ closed M&A transactions, including trade exits, private equity placements, MBOs, acquisitions and mezzanine financing.

- Since 2014, as a business angel investor, sourced, fundraised, and led several deals, including Netsprint (MBO in 2014, exit in 2016), Packhelp (seed round in 2017, exit in 2019), Fenige (seed round in 2017, exit in 2022), and Salad Story (expansion capital investment in 2017).

- Graduated from the Warsaw School of Economics and the CEMS Master in International Management. He also studied at the University of Cologne and the Anderson School of Management at UCLA.

- Passionate traveler, biker, skier, kitesurfer and photographer. Father of two daughters.

- Sectors expertise: Fintech, Edtech, Future of Life and Work.

Happy to anwswer your questions:

Radosław Rejman

20+ years of experience in corporate finance and investment management, both as a manager, advisor, and investor.

-

Professional experience in executive roles covering asset management, manufacturing, and trade.

-

Responsible for operations and financial management at two fund management companies and two brokerage houses, 10+ years at executive boards in financial institutions.

- Key roles in investment and restructuring projects, including the Hoesch Design takeover by Sanplast, co-management of the SEB TFI acquisition and post-merger integration by Opera TFI, and co-investment in the Netsprint MBO, Packhelp and Fenige pre-seed rounds with a successful exit.

- Completed over 20 PE/VC transactions since 2003.

- Licensed investment advisor by the Polish Financial Supervision Commission, ACCA Professional, CFA, and certified PADI Open Water Scuba Instructor (OWSI).

- Sectors expertise: Climate Tech, Health, Future of Life and Work, Marketplaces.

Happy to anwswer your questions:

Przemysław Jurgiel-Żyła

15 years of experience in building products and businesses.

- Over 20 years of experience in sales.

- At Netsprint and Datarino, he delivered solutions for the adtech, martech, fintech, and research markets.

- He led teams developing advertising technologies, data warehouses, consumer behavior analysis & ML tools (based on online and offline data), financial risk assessment and cybersec systems.

- For 16 years, he has been active in the Industry 4.0 space through the Polish Chamber of Commerce for Electronics and Telecommunications (KIGEiT), where he successfully supports the Management Board as a supervisory board member.

- After hours: maker (founder and president of the Makerspace Warsaw Association) and podcaster (co-creator of a digital transformation and cybersec podcasts).

- Sectors expertise: AI, Machine Learning, eCommerce, Marketplaces, Enterprise Software, B2B SaaS, Product-led Growth, and Open-Source.

Happy to anwswer your questions:

Michał Olszewski

Partner at Movens Capital, with 17 years of experience in venture capital, innovation, and fintech.

- Earlier, managed SkyCash (2009–2013), scaling it from an early-stage PoC to Poland’s leading mobile payment platform.

- Co-founded Business Angel Seedfund and one of Poland’s first angel networks (LBA), with successful investments including MEDICAlgorithmics.

- Led private equity deals at Opera AM, with multiple exits.

- Portfolio highlights: Doctor.One, Foractive, Vue Storefront.

- Sectors expertise: Fintech, Marketplaces, DeepTech, Edtech, Health, and patent-based investments.

Happy to anwswer your questions:

Maciej Kraus

15 years of business experience in strategic consulting.

- Extensive knowledge and hands-on experience with multinational companies – over 200 completed projects.

- Expert in marketing and a recognized authority in pricing strategies.

- Founded Fern Partners and successfully sold the company to PwC.

- Lecturer in pricing at Stanford MBA; holds a PhD.

- Member of the Advisory Board at StartX – a startup accelerator affiliated with Stanford University.

- Active angel investor with four investments and one successful exit.

- Strong networker with broad connections among entrepreneurs and industry experts.

- ectors expertise: Enterprise Software, B2B SaaS, eCommerce, OpenSource.

Happy to anwswer your questions:

Zofia Sidorska

Over 12 years of experience managing Operations and Administration departments within corporate groups and investment funds.

- Oversight of operational budgets, liquidity management, and financial planning across multiple groups of companies.

-

Coordination with legal advisors, auditors, tax consultants, and financial institutions; supervision of accounting and regulatory reporting (KNF, KRS, CRBR, tax office).

- Support for investment transactions and fund operations, including cooperation with portfolio companies and investor communications.

Happy to anwswer your questions:

Bartosz Składzień

10 years of experience in venture capital.

- Completed 15 VC transactions since 2015.

-

Graduated from the Warsaw School of Economics and CEMS Masters in International Management. He also studied at NOVA University Lisbon.

- Gained professional experience in investments and operations at EY, Giza Polish Ventures and BZ WBK.

- Sectors expertise: Deeptech, Robotics, Hardware.

Happy to anwswer your questions:

Łukasz Lewandowski

20 years of experience in building and managing digital ventures.

- Former VP & Board Member of K2 Holding – a Warsaw Stock Exchange–listed group, where he added new, high-impact services to K2’s offering.

- Managed K2 into Poland’s largest and most awarded digital agency.

- Founder & CEO of PerfectBot – a B2B SaaS (AI agent for eCommerce) which automated over 20 million customer conversations for top retailers (including IKEA, LPP, 4F, x-kom, Modivo, and Displate) and acquired over 100 customers in the US (including online stores from Brad Pitt, MrBeast, and David Beckham).

- CEO & Co-Founder of K2 Digital Ventures, where new ideas for corporations were turned into real ventures – from strategy decks to market launches.

- Member of the founding team at NetSprint.

- Graduate of the Warsaw School of Economics.

- Sectors expertise: AI, eCommerce, Enterprise Software, MarTech, SaaS.

Happy to anwswer your questions:

The latest from Movens

Movens Capital launches €60M fund to back CEE tech founders from pre-seed to Series A+

Backed by EBRD, PFR Ventures, and 40+ tech leaders from Central and Eastern Europe, the fund will target globally scalable tech companies from across the region.

Read more

Movens Capital’s Investment Theses in AI

The market is increasingly saturated with companies branding themselves as “AI-driven,” making informed investment decisions more complex.

To clarify our priorities, we’ve outlined our investment theses in AI below, blending opportunity with realism.

Read more

Let’s build together

Contact for Founders

Ready to scale globally? We are looking for:

Teams with strong technical know-how

Global ambitions

Path to €50M+ ARR

or get in touch with our investment team

Contact for Investors

Learn more how to become an investor in our €60M Fund 2 alongside EBRD, PFR Ventures and 80+ tech entrepreneurs and family offices backing CEE’s future champions.

Artur Banach